Individual Tax Rates 2025 South Africa. On 31 may 2025 the south african revenue services (sars) published notice no. Detailed description of taxes on individual income in south africa.

Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year. The tax rates for the 2025 tax year, starting on 1st march 2025 and ending on 28th february 2025 are:

Tax rates are proposed by the minister of finance in the annual budget speech and fixed or passed by parliament each year.

Tax rates for the 2025 year of assessment Just One Lap, Estate tax and donations tax. For individuals and sole proprietors, the threshold is r95 750, if you are younger than 65 years.

South African Company Tax Rate 2025 Image to u, Sars submission of income tax returns for the 2025 tax year. For the 2025/2025 tax year in south africa, income tax rates are structured to ensure a fair contribution from all earners, with rates ranging from 18% to 45%.

Tax Rates 2025 2025 Image to u, Detailed description of taxes on individual income in south africa. For individuals and sole proprietors, the threshold is r95 750, if you are younger than 65 years.

Highlights of Tax Reform Law (TRAIN) See the Tax Rates for 2019, Taxable income (r) rates of tax; And 2) july 31 for vat electronic filing and payment for category a taxpayers and estimated corporate income tax (cit).

T200018 Baseline Distribution of and Federal Taxes, All Tax, The rates of tax chargeable on taxable income are determined annually by parliament, and are generally referred to as “marginal rates of tax” or “statutory rates”. Rates of tax for individuals.

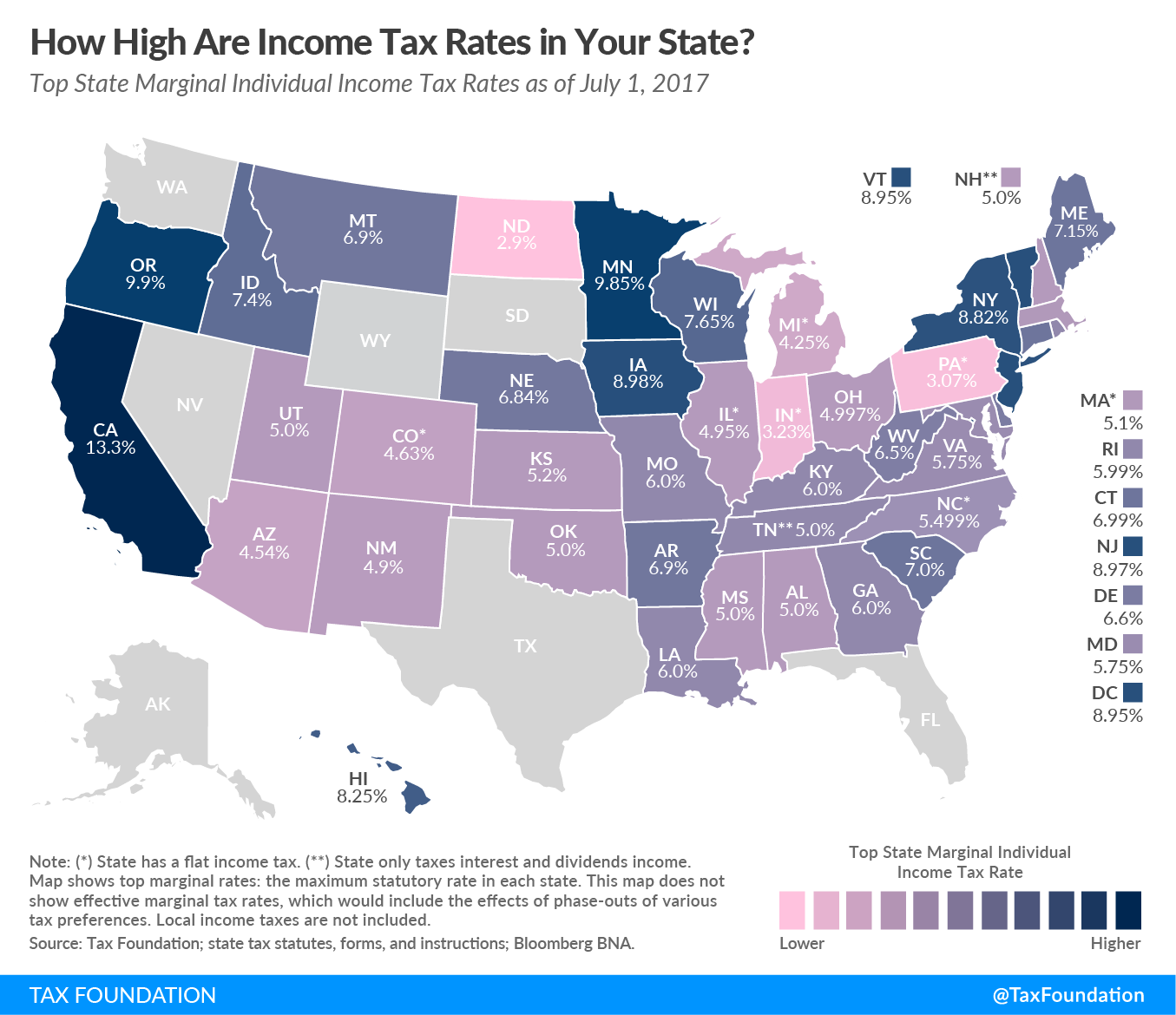

State Individual Tax Rates and Brackets 2017 Tax Foundation, Welcome to the 2025 income tax calculator for south africa which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable income in south africa in 2025. And 2) july 31 for vat electronic filing and payment for category a taxpayers and estimated corporate income tax (cit).

How Much Does Your State Rely on Individual Taxes?, The rates for the tax year commencing on 1 march 2025 and ending on 28 february 2025 are as follows: Sars provided details about the 2025 filing season dates.

National Budget Speech 2025 SimplePay Blog, On this page you will see individuals tax table, as well as the tax rebates and. Sars provided details about the 2025 filing season dates.

The highest tax rates in the world including South Africa, 2025 / 2025 tax year: Any person who was physically present in south africa for greater than 91 days per tax year for 6 consecutive tax years and was physically present for 915 days in aggregate during the first 5 years.

How to calculate gross Tax in South Africa Episode 2 part 2, You are viewing the income tax rates, thresholds and allowances for the 2025 tax year in south africa. 2025 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa.